IB Economics Inflation & CPI Explained

Why does Cadbury's Dairy Milk Whole Nut cost more now than in 2007? Inflation explained for IB Economics students - CPI stats and real-life examples included.

IB ECONOMICS HLIB ECONOMICSIB ECONOMICS MACROECONOMICSIB ECONOMICS SL

Lawrence Robert

4/24/20254 min read

Inflation: Why That £3 Meal Deal Now Costs £4.25

Well, let's think about the following situation, you walk into your local supermarket, on your school break expecting your trusty £3 meal deal, only to find it's now £4.25. Outrageous, right? But behind that price hike lies one of the biggest buzzwords in economics: inflation.

IB Economics What Is Inflation?

Inflation is when the general prices of goods and services rise over time, meaning your money buys you less. It’s like your £10 note slowly becoming worth a fiver - without physically shrinking.

A little inflation? Say from 2 to 3%? Totally normal. It keeps things working. Too much? It messes with confidence, wages, investment... basically everything. Ask Venezuela. Or even the UK in the 1970s.

Internal Assessment (IA) Guide – Free Download

Step-by-step support on topic selection, structure, evaluation, and most common IB Economics IA mistakes.

Understanding key IB Economics Internal Assessment concepts

Applying and explaining them in real-world IB Economics contexts

Building IB Economics IA confidence without drowning in dry theory and explanations.

Download the IA guide now for free and boost your IB Economics grades and confidence:

How Do We Measure Inflation in IB Economics? Meet the CPI

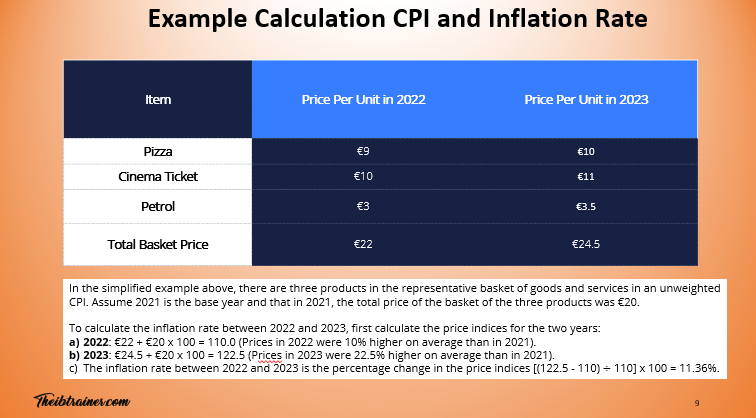

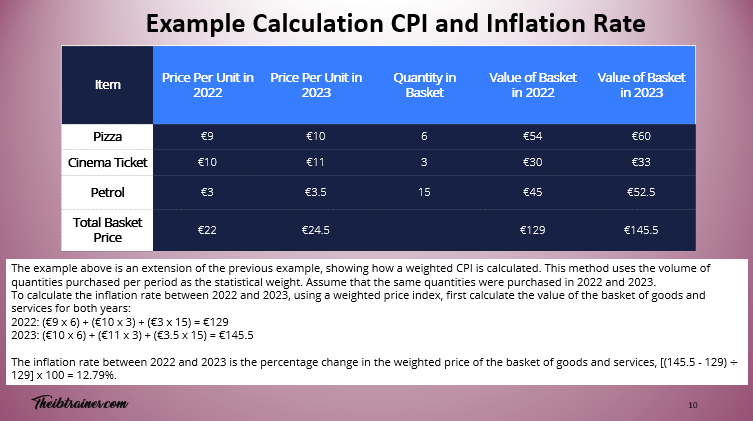

The Consumer Price Index (CPI) tracks the average price changes of a basket of goods and services. Think shopping trolley filled with everyday items: bread, rent, Netflix, petrol, cinema snacks. If the price of this trolley goes up, we’ve got inflation.

CPI works with weights, meaning not all items are equal. For example:

Milk = bought 10 times a month → higher weight

Washing machines = once every few years → lower weight

Even with clever stats, it’s far, really far from being perfect...

IB Economics CPI Limitations - Why It's Not the Whole Story

Not Everyone Buys the Same Stuff: CPI is based on the ‘average’ household, which might not be you or your nan or your flatmate living off instant noodles. What is "average" anyway?

Regional Price Differences: A pint in London? £6. A pint in Leeds? £3.50. CPI doesn’t always reflect that.

Quality Changes: Your phone might be pricier than last year, but it’s also 50x faster. CPI often ignores that.

Data Lag: CPI is based on past data, not real-time information. Inflation might feel worse (or better) than the number says.

Causes of Inflation in your IB Economics Course – Why Prices Go Up

1. Demand-Pull Inflation – Too Much Money Chasing Too Few Goods

IB Economics Real-life Example: Imagine it’s Glastonbury ticket release day. Everyone wants to be there. Demand is sky-high. Prices go up.

Same thing happens in an economy when demand surges and supply can’t keep up.

Things that can cause demand to spike:

Big tax cuts

Government intervention and spending sprees

Booming exports

Business or consumer confidence boosts

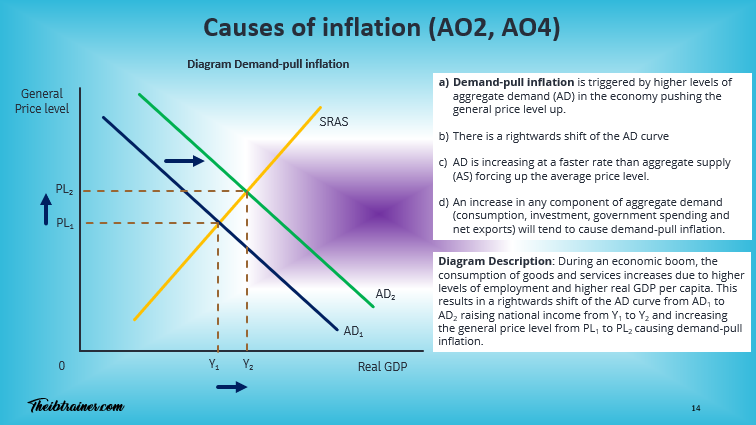

Economists diagram demand-pull inflation like this: During an economic boom, the consumption of goods and services increases due to higher levels of employment and higher real GDP per capita. This results in a rightwards shift of the AD curve from AD1 to AD2 raising national income from Y1 to Y2 and increasing the general price level from PL1 to PL2 causing demand-pull inflation.

2. Cost-Push Inflation – When It Costs More to Make Stuff

If petrol prices soar, delivery costs rise. That affects everything from tomatoes to T-shirts. Producers pass on the higher costs to YOU.

Reasons why costs rise:

Higher wages (yay for workers, less yay for inflation)

More expensive raw materials (blame global supply chains)

Increased taxes on production

Soaring rent for businesses

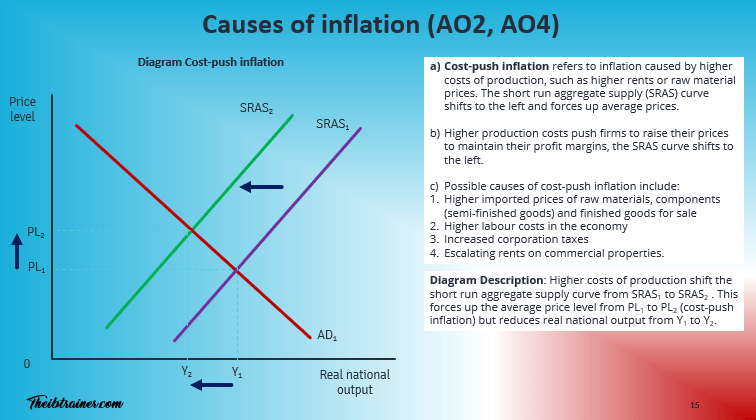

Economists Diagram this like: Higher costs of production shift the short run aggregate supply curve from SRAS1 to SRAS2. This forces up the average price level from PL1 to PL2 (cost-push inflation) but reduces real national output from Y1 to Y2.

For access to all IB Economics exam practice questions, model answers, IB Economics complete diagrams together with full explanations, and detailed assessment criteria, explore the Complete IB Economics Course:

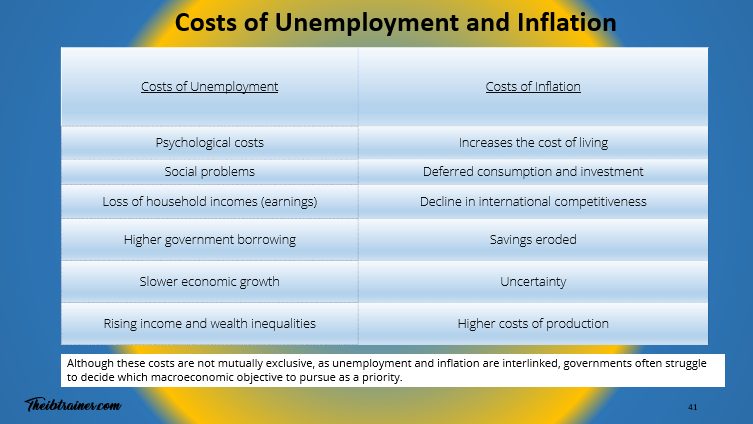

IB Economics Why High Inflation is a Big Deal

1. Uncertainty for Everyone

When inflation goes wild, nobody knows what tomorrow's prices will be. Businesses delay investing. Households hold off spending. Economic growth slows.

2. Hurts the Poor More

If the price of food and energy rises, it hits low-income households hardest. Inflation isn’t equal-opportunity proof.

Every episode of Pint-Sized links back to what matters most for your IB Economics course:

Understanding key IB Economics concepts

Applying them in real-world IB Economics contexts

Building IB Economics course confidence without drowning in dry theory.

Subscribe for free to exclusive episodes designed to boost your IB Economics grades and confidence:

3. Savers Get Burnt

Got a savings account paying 2%? If inflation is 5%, your money’s losing value while it naps in the bank.

4. Bad for Exporters

If your prices go up faster than other countries, your exports become too pricey. Foreign buyers look elsewhere. Bye-bye competitiveness.

5. Messes Up Growth

Inflation increases costs → lowers investment returns → less spending on growth. Think of it like sand in the economic engine.

IB Economics Diagrams Programme, What's included:

200+ exam-ready diagrams covering the entire IB Economics syllabus

Video for every diagram showing you exactly how each model looks

Image version perfect for modelling diagrams in you essays, presentations, and your IA

Detailed written explanations of the IB Economics theory behind each diagram

Both SL and HL IB Economics diagrams clearly labelled and organised by topic

Real IB Economics exam application showing how to use diagrams effectively in Paper 1 and Paper 2

Stay well,

Explore Topics:

IB Economics Macroeconomics Page

Read Next: IB Economics Deflation

© Theibtrainer.com 2012-2026. All rights reserved.

More Basic Resources For IB Students:

Legal

Have a Tip? Send us a tip using our anonymous form